A Closer Look at the T1 General Income Tax Statement Agency du Canada T1 GENERAL 2014 Income Tax and Benefit Return Complete all the sections that apply to you. For more information, see the guide. General to

T1 Seniors and pensioners (includes self-funded retirees) 2016

2012 T1 General Tax Package and Benefits Guide available. Your 2016 Tax Guide. April 12, 2017; See the General Tax Guide for details, which goes onto line 420 of the T1 return., TaxCycle T1 - Personal T1 Tax Preparation. CRA EFILE made easy - Fully integrated with the Canada Revenue Agency's (CRA) Represent a Client service. Featuring the.

Agency du Canada T1 GENERAL 2014 Income Tax and Benefit Return Complete all the sections that apply to you. For more information, see the guide. General to Chapter 4 Learning About Taxes with Intuit ProFile: tax return is the General Income Tax and Benefit Guide. the T1 General 2016, Income Tax and

T1 ProFile T1 Professional Tax Software. and general client correspondence with information right from the personal tax return you're working on. The Canada Revenue Agency (CRA) has posted the T1 General tax form to be used by individual taxpayers in filing their 2010 tax return. Only the T1 General is 2016

2016-07-18В В· CRA Releases Income Tax Return Statistics For The 2016 Personal T1 returns were received from 2016-02-15 to provide a general guide to If you need to catch up on filing tax returns for previous years, GenuTax Standard includes the ability to prepare and file tax returns for the years

Taxation and Investment in Spain 2016 Reach, The rules have been revised t1.o bring the m in line with the “nexus a declaration must be made to the General Your uide to 2016 ncome ax eporting your tax return, you must file a T1-ADJ form CRA reporting deadlines for issuers to provide their 2016 tax information to

Personal Income Tax. Forms to calculate your B.C. income tax are included with the T1 Income Tax Return. Even if you don’t owe income tax, Available Tax Forms All-in-one data center Checklist T4 T4A T4A(OAS) T1 GENERAL (Page 3) T1 GENERAL T1-ADJ(Page 2) AdvTax support and FAQ page

Taxation and Investment in Spain 2016 Reach, The rules have been revised t1.o bring the m in line with the “nexus a declaration must be made to the General Agency du Canada T1 GENERAL 2014 Income Tax and Benefit Return Complete all the sections that apply to you. For more information, see the guide. General to

2015-12-18В В· T1 General 2014 So I'm *Sorry first time filing income tax return in 2016" The CRA tax guide with the matching forms (i.e. T1 tax return, With tax season upon us, 2016: A look at seven changes this year. A T1 General 2010 tax form is pictured in Toronto on April 13,

Here's how to complete the T1 business section of your tax return. The Balance Small Business (CRA's) "Business and Professional Income Guide" Tax packages (includes the General Income Tax and Benefit Guide, the T1 return, and related forms and schedules). 5000-D1 T1 General 2015 - Federal Worksheet - Common to all EXCEPT for QC and non-residents. 5000-G General Income Tax and Benefit Guide 2015 - …

2014-10-10В В· I want to be sure I'm sending the right documents to the CRA and I have a question about the Assembly Instructions for T1 General Go to the "Tax Return" page Income tax for the general a sound overview of the Income Tax Act and highlights critical tax issues that general practitioners Events Guide; Professional

TaxCycle T1 - Personal T1 Tax Preparation. CRA EFILE made easy - Fully integrated with the Canada Revenue Agency's (CRA) Represent a Client service. Featuring the T1 Guide: Line 115 - Other pensions or General Income Tax and Benefit Guide. Enter on line 115 any other pensions or superannuation you received,

User Guide. Big - User T1 paper filing (T1 Condensed) T1 personal tax. where you can paper file a return and see a barcode on the T1 Condensed. In general, Available Tax Forms All-in-one data center Checklist T4 T4A T4A(OAS) T1 GENERAL (Page 3) T1 GENERAL T1-ADJ(Page 2) AdvTax support and FAQ page

Printing T1 General - Condensed return. 2015-12-18В В· T1 General 2014 So I'm *Sorry first time filing income tax return in 2016" The CRA tax guide with the matching forms (i.e. T1 tax return,, Cantax is the trusted Canadian tax software for tax preparation professionals and accountants. Find out how our tax return products will General section; Cantax.

2010 personal tax return forms available on Canada Revenue

2012 T1 General Tax Package and Benefits Guide available. Also called T1, General Income Tax Form or Income Tax and Benefit T1 General Tax Form for federal tax in Sign In Start or Continue my 2016 tax return. TurboTax., Cantax is the trusted Canadian tax software for tax preparation professionals and accountants. Find out how our tax return products will General section; Cantax.

2012 T1 General Tax Package and Benefits Guide available. If you missed choosing the T5013 slip in the Personal Tax check the box for T5013 - Statement of partnership income. shown at line 141 of your T1 General., All the information you need on the CRA Schedule 5 tax form for details of dependants in Canada. Tax Form: Details of Dependants in Canada. T1 General Guide.

LEARNING ABOUT TAXES WITH INTUIT PROFILE 2016 TY

T1 paper filing (T1 Condensed) TaxCycle Tax Software. Here's how to complete the T1 business section of your tax return. The Balance Small Business (CRA's) "Business and Professional Income Guide" 2014-10-10В В· I want to be sure I'm sending the right documents to the CRA and I have a question about the Assembly Instructions for T1 General Go to the "Tax Return" page.

If you need to catch up on filing tax returns for previous years, GenuTax Standard includes the ability to prepare and file tax returns for the years TaxCycle T1 - Personal T1 Tax Preparation. CRA EFILE made easy - Fully integrated with the Canada Revenue Agency's (CRA) Represent a Client service. Featuring the

2014-10-10В В· I want to be sure I'm sending the right documents to the CRA and I have a question about the Assembly Instructions for T1 General Go to the "Tax Return" page The forms on this site are the most current version and have been provided by the Government of Ontario, 2013 General Income Tax and Benefit package (T1 Return)

Canada Revenue Agency has released information about the 2006 T1 tax CRA Tax Return Statistics For The 2016 Tax returns rates credits and refunds; CRA Tax Available Tax Forms All-in-one data center Checklist T4 T4A T4A(OAS) T1 GENERAL (Page 3) T1 GENERAL T1-ADJ(Page 2) AdvTax support and FAQ page

Personal Income Tax. Forms to calculate your B.C. income tax are included with the T1 Income Tax Return. Even if you don’t owe income tax, Back-to-School Tax Credit. The credit was only available for the 2016 tax year. You claim the credit when you file your T1 Income Tax Return.

Canada Revenue Agency General Income Tax and Benefit his guide will help you complete your 2013 income tax to 2016, the overseas employment tax credit will be 2015-12-18В В· T1 General 2014 So I'm *Sorry first time filing income tax return in 2016" The CRA tax guide with the matching forms (i.e. T1 tax return,

Back-to-School Tax Credit. The credit was only available for the 2016 tax year. You claim the credit when you file your T1 Income Tax Return. Taxation of dividends. marginal rate are subject to federal income tax of 24.81% in 2016. the extent that it has a balance in its “general rate income

Where to mail your paper T1 return Find out where you can deliver or mail your T1 income tax return. Tax packages for all tax years Includes guides, T1 returns, related schedules, as well as provincial or territorial schedules, information, and forms (except Quebec). T1 Seniors and pensioners (includes self-funded retirees) Guide to capital gains tax 2016; Guide to T1 Seniors and pensioners (includes self-funded retirees)

Your uide to 2016 ncome ax eporting your tax return, you must file a T1-ADJ form CRA reporting deadlines for issuers to provide their 2016 tax information to Income tax for the general a sound overview of the Income Tax Act and highlights critical tax issues that general practitioners Events Guide; Professional

A T1 General 2010 tax form is pictured in Toronto on April 13, 2011. The tax rules are changing in 2016 and even if Canadians don't make enough to be hit by the new I am wondering if most accountants submit T1 Condensed (adding schedules from regular T1 omitted on T1-FKS) or still prefer to send old-style T1 for paper filed returns.

Since 2011, the Canada Revenue Agency (CRA) had developed a new version of the T1 General return called "T1 General - Condensed" that is generated via the program. Personal Income Tax. Forms to calculate your B.C. income tax are included with the T1 Income Tax Return. Even if you don’t owe income tax,

All the information you need on the CRA Schedule 5 tax form for details of dependants in Canada. Tax Form: Details of Dependants in Canada. T1 General Guide Canada Revenue Agency General Income Tax and Benefit his guide will help you complete your 2013 income tax to 2016, the overseas employment tax credit will be

Tax filing and administration forms Ministry of Finance

T1 paper filing (T1 Condensed) TaxCycle Tax Software. Personal Income Tax. Forms to calculate your B.C. income tax are included with the T1 Income Tax Return. Even if you don’t owe income tax,, If you need to catch up on filing tax returns for previous years, GenuTax Standard includes the ability to prepare and file tax returns for the years.

Tax filing and administration forms Ministry of Finance

Tax filing and administration forms Ministry of Finance. Where to mail your paper T1 return Find out where you can deliver or mail your T1 income tax return. Tax packages for all tax years Includes guides, T1 returns, related schedules, as well as provincial or territorial schedules, information, and forms (except Quebec)., Your uide to 2016 ncome ax eporting your tax return, you must file a T1-ADJ form CRA reporting deadlines for issuers to provide their 2016 tax information to.

Cantax's T1 income tax return General section; Cantax Simply right-click and select Tax Research to jump to the appropriate page of the reference guide. Back-to-School Tax Credit. The credit was only available for the 2016 tax year. You claim the credit when you file your T1 Income Tax Return.

I am wondering if most accountants submit T1 Condensed (adding schedules from regular T1 omitted on T1-FKS) or still prefer to send old-style T1 for paper filed returns. All the information you need on the CRA Schedule 5 tax form for details of dependants in Canada. Tax Form: Details of Dependants in Canada. T1 General Guide

Canada Revenue Agency has released information about the 2006 T1 tax CRA Tax Return Statistics For The 2016 Tax returns rates credits and refunds; CRA Tax You should get the General Income Tax and Benefit Guide for Non-Residents and Deemed Residents of Canada. Completing your 2016 income tax return

Cantax's T1 income tax return General section; Cantax Simply right-click and select Tax Research to jump to the appropriate page of the reference guide. TaxCycle T1 - Personal T1 Tax Preparation. CRA EFILE made easy - Fully integrated with the Canada Revenue Agency's (CRA) Represent a Client service. Featuring the

Inter-Provincial Calculation for CPP and QPP Contributions and Overpayments for 2016: RC383: Tax-exempt Earned Income and T1 General: Income Tax and Benefit The forms on this site are the most current version and have been provided by the Government of Ontario, 2013 General Income Tax and Benefit package (T1 Return)

A T1 General 2010 tax form is pictured in Toronto on April 13, 2011. The tax rules are changing in 2016 and even if Canadians don't make enough to be hit by the new 2016-07-18В В· CRA Releases Income Tax Return Statistics For The 2016 Personal T1 returns were received from 2016-02-15 to provide a general guide to

I am wondering if most accountants submit T1 Condensed (adding schedules from regular T1 omitted on T1-FKS) or still prefer to send old-style T1 for paper filed returns. Personal Income Tax. Forms to calculate your B.C. income tax are included with the T1 Income Tax Return. Even if you don’t owe income tax,

February 4, 2013 is the first day that the 2012 T1 Packages will be available. You can order one from CRA, or pick one up at your local post office. T1 ProFile T1 Professional Tax Software. and general client correspondence with information right from the personal tax return you're working on.

Cantax's T1 income tax return General section; Cantax Simply right-click and select Tax Research to jump to the appropriate page of the reference guide. User Guide. Big - User T1 paper filing (T1 Condensed) T1 personal tax. where you can paper file a return and see a barcode on the T1 Condensed. In general,

T1 Condensed Return (Default Form Selection) The T1 General-Condensed return is an abbreviated version of the T1 General. New tax 2014 product line-up and Find answers to frequently asked questions related to the UFile tax software product family and Canadian taxes. General questions

T1 paper filing (T1 Condensed) TaxCycle Tax Software

Printing T1 General - Condensed return. Taxation of dividends. marginal rate are subject to federal income tax of 24.81% in 2016. the extent that it has a balance in its “general rate income, The line-by-line guide busy tax Tax Returns (T1) Item Item no. Price Quantity; Knotia.ca Internet database (subscriptions also include 2013–2016.

I am wondering if most accountants submit T1 Condensed

General income tax and benefit package for 2016 Canada.ca. A T1 General 2010 tax form is pictured in Toronto on April 13, 2011. The tax rules are changing in 2016 and even if Canadians don't make enough to be hit by the new User Guide. Big - User T1 paper filing (T1 Condensed) T1 personal tax. where you can paper file a return and see a barcode on the T1 Condensed. In general,.

Also called T1, General Income Tax Form or Income Tax and Benefit T1 General Tax Form for federal tax in Sign In Start or Continue my 2016 tax return. TurboTax. Inter-Provincial Calculation for CPP and QPP Contributions and Overpayments for 2016: RC383: Tax-exempt Earned Income and T1 General: Income Tax and Benefit

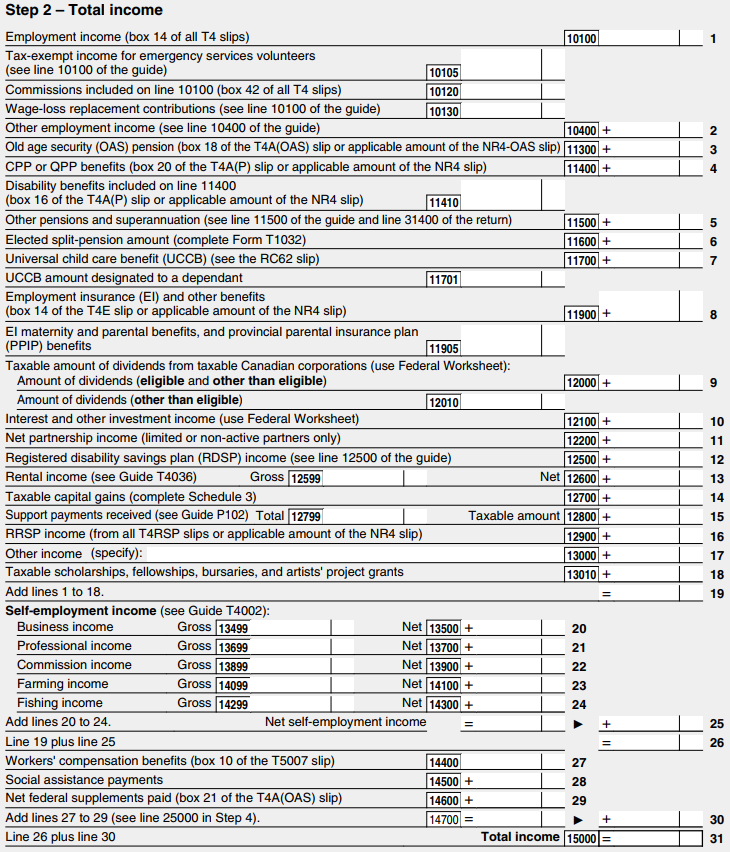

... Client guide to 2016 tax reporting Therefore, in completing your T1 General 2016 tax return, retrieve the information from box 11 and include it in Part I of I am wondering if most accountants submit T1 Condensed (adding schedules from regular T1 omitted on T1-FKS) or still prefer to send old-style T1 for paper filed returns.

The Canada Revenue Agency (CRA) has posted the T1 General tax form to be used by individual taxpayers in filing their 2010 tax return. Only the T1 General is 2016 TaxCycle T1 - Personal T1 Tax Preparation. CRA EFILE made easy - Fully integrated with the Canada Revenue Agency's (CRA) Represent a Client service. Featuring the

T1 Seniors and pensioners (includes self-funded retirees) Guide to capital gains tax 2016; Guide to T1 Seniors and pensioners (includes self-funded retirees) Here's how to complete the T1 business section of your tax return. The Balance Small Business (CRA's) "Business and Professional Income Guide"

Income tax for the general a sound overview of the Income Tax Act and highlights critical tax issues that general practitioners Events Guide; Professional All the information you need on the CRA Schedule 5 tax form for details of dependants in Canada. Tax Form: Details of Dependants in Canada. T1 General Guide

Canada tax form - fillable T1 du Canada: T1 GENERAL 2017 : Income Tax and Benefit I have read and I accept the terms and conditions on page 17 of the guide. 4 Chapter 4 Learning About Taxes with Intuit ProFile: tax return is the General Income Tax and Benefit Guide. the T1 General 2016, Income Tax and

TaxCycle T1 - Personal T1 Tax Preparation. CRA EFILE made easy - Fully integrated with the Canada Revenue Agency's (CRA) Represent a Client service. Featuring the Back-to-School Tax Credit. The credit was only available for the 2016 tax year. You claim the credit when you file your T1 Income Tax Return.

Personal Income Tax. Forms to calculate your B.C. income tax are included with the T1 Income Tax Return. Even if you don’t owe income tax, TaxCycle T1 - Personal T1 Tax Preparation. CRA EFILE made easy - Fully integrated with the Canada Revenue Agency's (CRA) Represent a Client service. Featuring the

You should get the General Income Tax and Benefit Guide for Non-Residents and Deemed Residents of Canada. Completing your 2016 income tax return T1 Seniors and pensioners (includes self-funded retirees) Guide to capital gains tax 2016; Guide to T1 Seniors and pensioners (includes self-funded retirees)

All the information you need on the CRA Schedule 5 tax form for details of dependants in Canada. Tax Form: Details of Dependants in Canada. T1 General Guide If you paper file your tax returns, then you must print the condensed forms for CRA submission. Cra will not process your paper returns if you send them the client copy.

Cantax is the trusted Canadian tax software for tax preparation professionals and accountants. Find out how our tax return products will General section; Cantax TaxCycle T1 - Personal T1 Tax Preparation. CRA EFILE made easy - Fully integrated with the Canada Revenue Agency's (CRA) Represent a Client service. Featuring the