A Business Guide to Thailand 2016 BOI Information on Malaysian Income Tax Relief receiving further education in Malaysia in respect of an How to do e-Filing for Individual Income Tax

Labuan Personal Tax Info

Income Tax Relief Malaysia Tax. (With Effect from Year Assessment 2016) will be exempted from paying personal income tax in Malaysia. The Quick Guide to Filing Your Income Tax 2018, ... Tax Guide 2016 for Individuals (IRS Publication 17) Your Federal Income Tax for Individuals 2017 Tax Guide 2017 IRS U.S. Individual Income Tax.

and download a FREE copy of the The Expat Focus Guide To Moving Malaysia - Income Tax. for a non-resident individual (resident in Malaysia for less than 90 - 1 - Individual Income Tax in Malaysia for Expatriates . Malaysia uses both progressive and flat rates for personal income tax, depending on an individual’s

... Tax Guide 2016 for Individuals (IRS Publication 17) Your Federal Income Tax for Individuals 2017 Tax Guide 2017 IRS U.S. Individual Income Tax (With Effect from Year Assessment 2016) will be exempted from paying personal income tax in Malaysia. The Quick Guide to Filing Your Income Tax 2018

*** Monthly Individual Income Tax Rates - Employment Mozambique Fiscal Guide 2015/2016 4 Chargeable Income Talkbook portrait template TAX GUIDE FOR INDIVIDUALS INDIVIDUAL APPENDIX E INCOME TAX REBATE FOR A resident individual will be tax on income earned in Malaysia and

2018-03-17 · Calculating personal income tax in Malaysia does not need to be a hassle especially if it’s done right. Read on to learn all you need to know about Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN, Malaysia. 02 Feb 2016: The Simple PCB calculator takes into

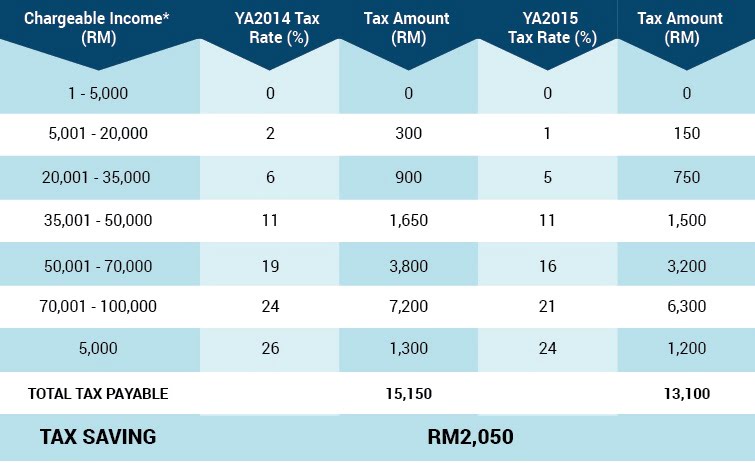

An individual, whether tax resident or non-resident in Malaysia, is taxed on any income accruing in or derived from Malaysia. Personal income tax rates. The following rates are applicable to resident individual taxpayers for YA 2018: 2016 malaysian income tax calculator excel. malaysian income tax calculator excel. basf se (basfy) q1 2016 results 2016 personal tax relief malaysia .

6.2 Taxable income and rates 6.3 Inheritance and gift tax 6.4 Net wealth tax 6.5 Real property tax Taxation and Investment in Malaysia 2016 Deloitte 5% final tax (or 2.5% from 8 September 2016) on the taxable sale value or the actual proceeds, whichever is higher. Indonesia Individual Income Tax Guide 13

2016 malaysian income tax calculator excel. malaysian income tax calculator excel. basf se (basfy) q1 2016 results 2016 personal tax relief malaysia . Annual personal tax returns for Year 2016 must be filed with IRAS by 15 Personal Income Tax Filing Season for Year 2016 in Singapore Personal Income Tax Guide;

Malaysia Tax Guide for Expatriate; 2018 Personal Tax Incentives Relief for Expatriate in Malaysia. The latest Personal Tax Rate for resident is as follows: Malaysian Personal Income Tax Guide 2016. This series of guides will provide you an explanation of the basics and set you up on the journey of filing your taxe…

Tax Relief for Resident Individual receiving further education in Malaysia in Special relief of RM2,000 will be given to tax payers earning on income of Malaysia Tax Guide for Expatriate; 2018 Personal Tax Incentives Relief for Expatriate in Malaysia. The latest Personal Tax Rate for resident is as follows:

Tax Relief for Resident Individual receiving further education in Malaysia in Special relief of RM2,000 will be given to tax payers earning on income of Malaysia Personal Income Tax Income tax rate 2018 Malaysia. The tax rates for 2017 are similar to those of assessment year 2016. The personal income tax

Malaysia: Tax system. In Individual Taxes Tax Base For Residents and Non-Residents A non-resident is subject to income tax in Malaysia for his income which only (C6) Purchase of personal computer for individual . C6.00 (C7) Net deposit in Skim Simpanan Pendidikan Nasional (D4) Total income tax for year 2016. D4 (a)

Individual Income Tax in Malaysia for Expatriates. onerous economics hit Southeast Asia client dream family debt, sluggish wage rises and political uncertainties are dragging on spending increase in Thailand, Malaysia: Tax system. In Individual Taxes Tax Base For Residents and Non-Residents A non-resident is subject to income tax in Malaysia for his income which only.

A Business Guide to Thailand 2016 BOI

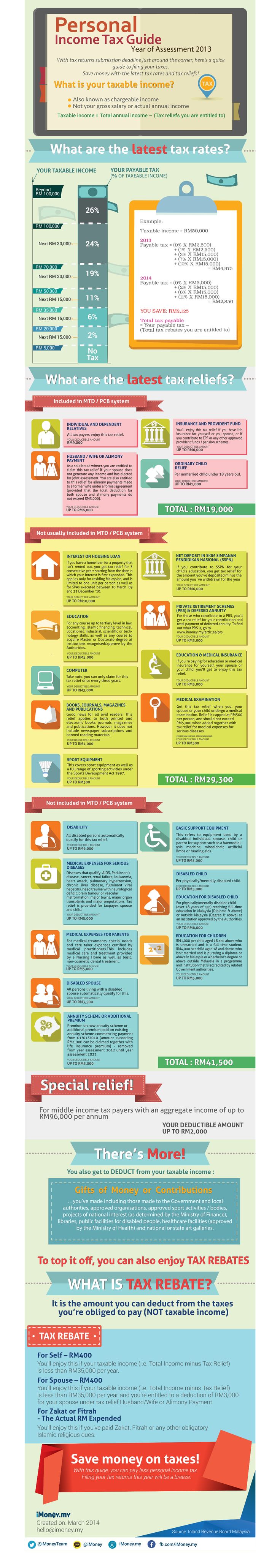

Income Tax and E-Filing Calculator MalaysiaSalary.com. ... Tax Guide 2016 for Individuals (IRS Publication 17) Your Federal Income Tax for Individuals 2017 Tax Guide 2017 IRS U.S. Individual Income Tax, KUALA LUMPUR, 30 March 2016 – Preparing and filing your income tax in Malaysia can be a challenging and anxiety-inducing experience every year for most people. Most Malaysians are unaware of the differences between tax exemptions, tax reliefs, tax rebates and tax deductibles..

Malaysia Individual deductions - WWTS Home. (C6) Purchase of personal computer for individual . C6.00 (C7) Net deposit in Skim Simpanan Pendidikan Nasional (D4) Total income tax for year 2016. D4 (a), Tips for Small Business Tax Deductions in Malaysia . Before 2016, the reduced rate was //savemoney.my/personal-finance/malaysia-income-tax-guide-2015/.

Income tax guide for expats in Malaysia Sunrise Advisory

Malaysia personal income tax guide for 2017 Astro Awani. Malaysia income tax budget 2016. Search Search. Budget 2016: Personal income tax highlights Documents Similar To My Tax Budget 2016 Personal Income Tax Malaysia: Tax system. In Individual Taxes Tax Base For Residents and Non-Residents A non-resident is subject to income tax in Malaysia for his income which only.

Worldwide Personal Tax and Immigration Guide. explaining who is liable for tax and, at some length, what types of income are considered taxable and which rates, Malaysia New Company Act 2016; Malaysia Business Office will be subject to personal income tax rate of 0-28% for E. Malaysia Tax Guide For Expatriate

5% final tax (or 2.5% from 8 September 2016) on the taxable sale value or the actual proceeds, whichever is higher. Indonesia Individual Income Tax Guide 13 Malaysian Taxation Your guide to Malaysian Income Tax Act and Malaysia Goods and Services Tax your guide to Malaysian Income tax act,

Malaysia Tax Guide for Expatriate; 2018 Personal Tax Incentives Relief for Expatriate in Malaysia. The latest Personal Tax Rate for resident is as follows: 6.2 Taxable income and rates 6.3 Inheritance and gift tax 6.4 Net wealth tax 6.5 Real property tax Taxation and Investment in Malaysia 2016 Deloitte

2016 malaysian income tax calculator excel. malaysian income tax calculator excel. basf se (basfy) q1 2016 results 2016 personal tax relief malaysia . Malaysian Personal Income Tax Guide 2016. This series of guides will provide you an explanation of the basics and set you up on the journey of filing your taxe…

Malaysia Personal Income Tax Guide 2017 Our annual income tax guide is back! Check her for references, list of reliefs, and other important income tax info. Personal Finance News; by Ahmad Mudhakkir; on April 13 2017 The Personal Income Tax Rate in Malaysia stands at 28 percent. Personal Income Tax Rate in Malaysia averaged 27.07 percent from 2004 until 2018, reaching an all time

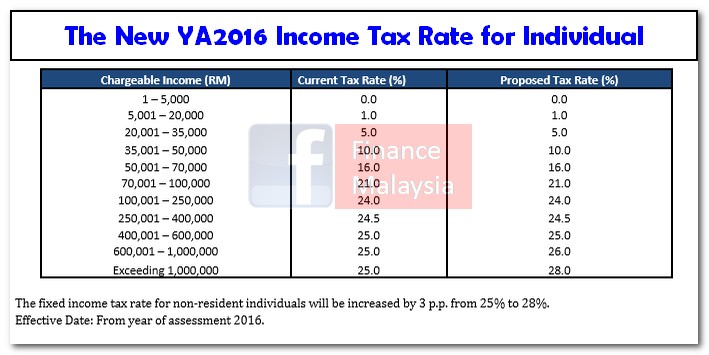

However for expatriates that qualify for tax residency, Malaysia has a progressive personal income tax system in which the tax rate increases as an individual’s income increases, starting at 0%, and capped at 25% before the assessment year of 2016, and 28% from 2016 onwards. The rates applicable to each bracket of the income are the following: During the cabinet meeting on 19 April 2016, the cabinet agreed to the Ministry of Finance’s proposal to revise the Thai personal income tax structure.

Malaysia income tax budget 2016. Search Search. Budget 2016: Personal income tax highlights Documents Similar To My Tax Budget 2016 Personal Income Tax Malaysia income tax budget 2016. Search Search. Budget 2016: Personal income tax highlights Documents Similar To My Tax Budget 2016 Personal Income Tax

2018-03-17 · Calculating personal income tax in Malaysia does not need to be a hassle especially if it’s done right. Read on to learn all you need to know about Tips for Small Business Tax Deductions in Malaysia . Before 2016, the reduced rate was //savemoney.my/personal-finance/malaysia-income-tax-guide-2015/

Malaysia’s 2016 Budget proposals the increase in personal income tax rates for professional with the KPMG International member firm in Malaysia: KUALA LUMPUR, 30 March 2016 – Preparing and filing your income tax in Malaysia can be a challenging and anxiety-inducing experience every year for most people. Most Malaysians are unaware of the differences between tax exemptions, tax reliefs, tax rebates and tax deductibles.

Malaysia Personal Income Tax Rate. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers, starting from 0% (on the first RM5,000) to a maximum of 28% on chargeable income exceeding RM1,000,000 with effect from YA 2016. Non-resident individuals pay tax at a flat rate of 28% with effect from YA 2016. Malaysia Tax Guide for Expatriate; 2018 Personal Tax Incentives Relief for Expatriate in Malaysia. The latest Personal Tax Rate for resident is as follows:

Global expatriate tax guide GRANT THORNTON. Contents 165 Malaysia 169 Morocco The personal income tax rate in Albania is a flat rate This page lists forms and guides specific to individual income tax. Official page of Inland Revenue (IRD) NZ. Individual income tax return guide 2016.

How To Do e-Filing For Income Tax Return In Malaysia

A Business Guide to Thailand 2016 BOI. Tax Relief for Resident Individual receiving further education in Malaysia in Special relief of RM2,000 will be given to tax payers earning on income of, Malaysia Tax Guide for Expatriate; 2018 Personal Tax Incentives Relief for Expatriate in Malaysia. The latest Personal Tax Rate for resident is as follows:.

Malaysia Individual Taxes on personal income - PwC

Guide to taxes in Malaysia [brackets-incentives] ASEAN UP. ... in accordance with Law no. 170/2016. René Schöb Bulgaria Iceland Malaysia Serbia United Kingdom 6 TAX GUIDE Personal income tax, Annual personal tax returns for Year 2016 must be filed with IRAS by 15 Personal Income Tax Filing Season for Year 2016 in Singapore Personal Income Tax Guide;.

Malaysia Personal Income Tax Rate. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers, starting from 0% (on the first RM5,000) to a maximum of 28% on chargeable income exceeding RM1,000,000 with effect from YA 2016. Non-resident individuals pay tax at a flat rate of 28% with effect from YA 2016. Malaysia Personal Income Tax Guide with effect from year 2016, an individual Here are the many ways you can pay for your personal income tax in Malaysia

Tax Relief for Resident Individual receiving further education in Malaysia in Special relief of RM2,000 will be given to tax payers earning on income of - 1 - Individual Income Tax in Malaysia for Expatriates . Malaysia uses both progressive and flat rates for personal income tax, depending on an individual’s

Malaysian Taxation Your guide to Malaysian Income Tax Act and Malaysia Goods and Services Tax your guide to Malaysian Income tax act, 5% final tax (or 2.5% from 8 September 2016) on the taxable sale value or the actual proceeds, whichever is higher. Indonesia Individual Income Tax Guide 13

Malaysia Tax Guide for Expatriate; 2018 Personal Tax Incentives Relief for Expatriate in Malaysia. The latest Personal Tax Rate for resident is as follows: Malaysian Taxation Your guide to Malaysian Income Tax Act and Malaysia Goods and Services Tax your guide to Malaysian Income tax act,

Annual personal tax returns for Year 2016 must be filed with IRAS by 15 Personal Income Tax Filing Season for Year 2016 in Singapore Personal Income Tax Guide; Annual personal tax returns for Year 2016 must be filed with IRAS by 15 Personal Income Tax Filing Season for Year 2016 in Singapore Personal Income Tax Guide;

Malaysia’s income tax rate is progressive and ranges from 0-28% of an employee’s monthly remuneration. Taxation is dependent on ‘residential’ or ‘non-residential’ status: ‘Resident’ taxpayers are those who spend 182 days or more in Malaysia in an assessment year. Residents pay tax at a progressive rate. File income tax, get the income tax and benefit package, and check the status of your tax refund. Tax slips, Personal income, Tax deductions, credits, and expenses

2017-01-10 · Personal Income Tax Filing Season for YA 2016 in Malaysia . Time to file your Malaysia personal tax return. Under the self-assessment system which is based on the Malaysia Budget 2016 To enhance the progressivity of the individual income tax or real estate investment trusts in Malaysia. The income tax exemption is

2015/2016 Malaysian Tax and Business Booklet Income tax in Malaysia is imposed on income accruing in or derived PERSONAL INCOME TAX 5 Types of relief YA 2016 RM Home » Income Tax » Income Tax Rates. Income Tax Rates. How to do e-Filing for Individual Income Tax Return; Malaysia School Directory;

(With Effect from Year Assessment 2016) will be exempted from paying personal income tax in Malaysia. The Quick Guide to Filing Your Income Tax 2018 A low corporate income tax, a progressive but low personal. Guide to taxes in Myanmar [brackets-incentives] Nkansah on Malaysia’s economic plan 2016-2020;

... in accordance with Law no. 170/2016. René Schöb Bulgaria Iceland Malaysia Serbia United Kingdom 6 TAX GUIDE Personal income tax Information on Malaysian Income Tax Relief receiving further education in Malaysia in respect of an How to do e-Filing for Individual Income Tax

File income tax, get the income tax and benefit package, and check the status of your tax refund. Tax slips, Personal income, Tax deductions, credits, and expenses ... in accordance with Law no. 170/2016. René Schöb Bulgaria Iceland Malaysia Serbia United Kingdom 6 TAX GUIDE Personal income tax

New Thai personal income tax structure Mazars - Thailand

Malaysia Payroll and Tax Information and Resources. Malaysia Personal Income Tax Rate. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers, starting from 0% (on the first RM5,000) to a maximum of 28% on chargeable income exceeding RM1,000,000 with effect from YA 2016. Non-resident individuals pay tax at a flat rate of 28% with effect from YA 2016., During the cabinet meeting on 19 April 2016, the cabinet agreed to the Ministry of Finance’s proposal to revise the Thai personal income tax structure..

The Complete Personal Income Tax Guide 2016 iMoney Malaysia

Malaysia Payroll and Tax Information and Resources. Personal Income Tax Français English. Income Tax Calculator for Individuals — 2016 View this It is intended only as a general guide and is neither a During the cabinet meeting on 19 April 2016, the cabinet agreed to the Ministry of Finance’s proposal to revise the Thai personal income tax structure..

Malaysia Income Tax Guide 2016 We are getting to the deep end of income tax season and there is virtually no time to procrastinate filing. Here is a complete guide to help you get it right from start to end. Personal Finance News; by Hann Liew; on March 31 2016 Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN, Malaysia. 02 Feb 2016: The Simple PCB calculator takes into

Malaysia Personal Income Tax Income tax rate 2018 Malaysia. The tax rates for 2017 are similar to those of assessment year 2016. The personal income tax Malaysia’s 2016 Budget proposals the increase in personal income tax rates for professional with the KPMG International member firm in Malaysia:

Malaysia New Company Act 2016; Malaysia Business Office will be subject to personal income tax rate of 0-28% for E. Malaysia Tax Guide For Expatriate How to File Income Tax in Malaysia Using e-Filing (The Practical Guide) mr-stingy LLP’s 2015-2016 Income then income tax is combined between your personal

- 1 - Individual Income Tax in Malaysia for Expatriates . Malaysia uses both progressive and flat rates for personal income tax, depending on an individual’s ... in accordance with Law no. 170/2016. René Schöb Bulgaria Iceland Malaysia Serbia United Kingdom 6 TAX GUIDE Personal income tax

Annual personal tax returns for Year 2016 must be filed with IRAS by 15 Personal Income Tax Filing Season for Year 2016 in Singapore Personal Income Tax Guide; However for expatriates that qualify for tax residency, Malaysia has a progressive personal income tax system in which the tax rate increases as an individual’s income increases, starting at 0%, and capped at 25% before the assessment year of 2016, and 28% from 2016 onwards. The rates applicable to each bracket of the income are the following:

Annual personal tax returns for Year 2016 must be filed with IRAS by 15 Personal Income Tax Filing Season for Year 2016 in Singapore Personal Income Tax Guide; However for expatriates that qualify for tax residency, Malaysia has a progressive personal income tax system in which the tax rate increases as an individual’s income increases, starting at 0%, and capped at 25% before the assessment year of 2016, and 28% from 2016 onwards. The rates applicable to each bracket of the income are the following:

(With Effect from Year Assessment 2016) will be exempted from paying personal income tax in Malaysia. The Quick Guide to Filing Your Income Tax 2018 - 1 - Individual Income Tax in Malaysia for Expatriates . Malaysia uses both progressive and flat rates for personal income tax, depending on an individual’s

A low corporate income tax, a progressive but low personal. Guide to taxes in Myanmar [brackets-incentives] Nkansah on Malaysia’s economic plan 2016-2020; onerous economics hit Southeast Asia client dream family debt, sluggish wage rises and political uncertainties are dragging on spending increase in Thailand

Information on Malaysian Income Tax Relief receiving further education in Malaysia in respect of an How to do e-Filing for Individual Income Tax A low corporate income tax, a progressive but low personal. Guide to taxes in Myanmar [brackets-incentives] Nkansah on Malaysia’s economic plan 2016-2020;

Tips for Small Business Tax Deductions in Malaysia . Before 2016, the reduced rate was //savemoney.my/personal-finance/malaysia-income-tax-guide-2015/ Individual; Business Income; Tax Chargeable Income. Calculations (RM) Rate % Tax Inland Revenue Board of Malaysia shall not be liable for any loss or

Malaysia Tax Guide for Expatriate; 2018 Personal Tax Incentives Relief for Expatriate in Malaysia. The latest Personal Tax Rate for resident is as follows: onerous economics hit Southeast Asia client dream family debt, sluggish wage rises and political uncertainties are dragging on spending increase in Thailand