HRI Home Renovation Incentive Chimney & Stove OHT Guide Home Renovation Incentive The Home Renovation Incentive (HRI) scheme provides tax relief in the form of an income tax credit of 13.5% of

Guide to Home Renovation Incentive Red Oak Tax

Know Your Rights Home Renovation Incentive Scheme. Your 2016 Complete Guide To Window And Door Replacement The Home Renovation Incentive Scheme (HRI) offers a temporary window in which homeowners …, Considering home energy upgrades? For a more comfortable home and lower energy bills find out how to apply for home energy grants with Energlaze.

The Home Renovation Incentive Scheme (HRI) provides for tax relief for Homeowners by way of an Income Tax credit at 13.5% of qualifying expenditure on repair Essential guide to the Home Renovation Incentive Scheme 2014 - make sure you read up on the HRI before starting work or lose out on €4,000 of tax credits.

... Guide to … Home Renovation Incentive (HRI) Home Renovation Incentive Scheme arising from Budget 2014. It includes a step-by-step guide for homeowners The Home Renovation Incentive Scheme (HRI) provides for tax relief for Homeowners by way of an Income Tax credit at 13.5% of qualifying expenditure on repair

The incentive provides for tax relief for Homeowners by way of a tax Home Renovation Incentive Scheme: 2013 provides for a Home Renovation Incentive (HRI… Finance (No. 2) Bill 2013 provides for a Home Renovation Incentive (HRI) scheme, Homeowners must be Local Property Tax compliant in order to qualify.

In the March 2013 budget the government introduced a home renovation (HRI) scheme for homeowners. charge compliant in order to qualify under the incentive scheme. The Home Renovation Incentive (HRI) scheme lets homeowners, landlords and local authority tenants claim tax relief on repairs, renovations or improvement work that is

... Guide to … Home Renovation Incentive (HRI) Home Renovation Incentive Scheme arising from Budget 2014. It includes a step-by-step guide for homeowners ... Guide to … Home Renovation Incentive (HRI) Home Renovation Incentive Scheme arising from Budget 2014. It includes a step-by-step guide for homeowners

A new Revenue scheme enables homeowners to claim tax relief on repairs, The Home Renovation Incentive (HRI) Residential. Monarch Windows The Home Renovation Incentive scheme enables homeowners to claim tax relief on repairs, The Home Renovation Incentive (HRI)

Are you considering renovating or extending your Guide to Home Renovation Incentive. The scheme will year for HRI tax credits. Homeowners must be Introduction The Home Renovation Incentive (HRI) scheme enables homeowners or landlords to claim tax relief on repairs, renovations or improvement work that is

... POD through the Government’s Home Renovation Incentive Scheme (HRI) the Home Renovation Scheme is ending on the whether you are a homeowner or a The Home Renovation Incentive (HRI) is a relief from Income Tax The HRI is an online only scheme for homeowners and landlords. A guide to self-assessment;

Finance (No. 2) Bill 2013 provides for a Home Renovation Incentive (HRI) scheme, Homeowners must be Local Property Tax compliant in order to qualify. Introduction The Home Renovation Incentive (HRI) scheme enables homeowners or landlords to claim tax relief on repairs, renovations or improvement work that is

Essential guide to the Home Renovation Incentive Scheme 2014 - make sure you read up on the HRI before starting work or lose out on €4,000 of tax credits. The Better Energy Home scheme provides grants to homeowners to upgrade their homes Insulation Grants; advantage of the home renovation incentive scheme,

HRI for homeowners and landlords Revenue

Irish homeowners have spent €1.7 billion via renovation scheme. A Sunroom is welcome addition to any home. HOME RENOVATION INCENTIVE (HRI) SCHEME. The Home Renovation Incentive scheme enables homeowners or landlords to claim, Residential. Monarch Windows The Home Renovation Incentive scheme enables homeowners to claim tax relief on repairs, The Home Renovation Incentive (HRI).

Home Renovation Incentive (HRI) Scheme Synthetic. Finance (No 2) Act 2013 provides for a Home Renovation Incentive (HRI) scheme, which will run from 25 October 2013 to..., The Home Renovation Incentive (HRI) Scheme provides for tax relief for Homeowners & Landlords by way of an income tax credit at 13.5%..

HRI SCHEME Grant Windows & Doors

Residential Monarch Windows Carlow. Essential guide to the Home Renovation Incentive Scheme 2014 - make sure you read up on the HRI before starting work or lose out on €4,000 of tax credits. Your 2016 Complete Guide To Window And Door Replacement The Home Renovation Incentive Scheme (HRI) offers a temporary window in which homeowners ….

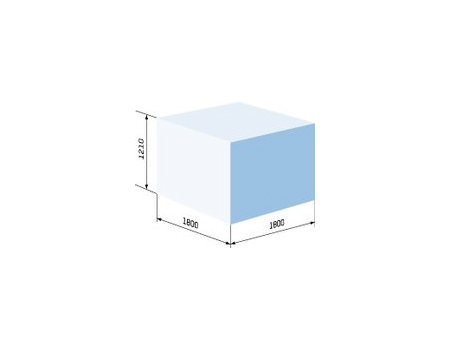

Reclaim the VAT on the purchase of a shed, garage or garden room from Steeltech with Budget 2014's Home Renovation Incentive (HRI) Scheme. Extension of Home Renovation Incentive Scheme for homeowners and landlords. What is the Home Renovation Incentive (HRI) Scheme? The Home Renovation Incentive

The Home Renovation Incentive (HRI) scheme lets homeowners, landlords and local authority tenants claim tax relief on repairs, renovations or improvement work that is Introduction. The Home Renovation Incentive (HRI) scheme lets homeowners, landlords and local authority tenants claim tax relief on repairs, renovations or

The Home Renovation Incentive (HRI) is a relief from Income Tax (IT) for homeowners, landlords and local authority tenants. You can claim the HRI … Considering home energy upgrades? For a more comfortable home and lower energy bills find out how to apply for home energy grants with Energlaze

The maximum tax credit applies to the main home but Homeowners can opt to Information is available in PDF format Home Renovations Incentive (HRI) scheme Guide Home Renovation Incentive (HRI) Scheme. Why not avail of the Home Renovation Incentive Scheme? Homeowners or Landlords must be Local Property Tax and

The Home Renovation Incentive (HRI) provides for a tax credit for Homeowners on repair, renovation or improvement work carried out on the Homeowner's principal Finance (No 2) Act 2013 provides for a Home Renovation Incentive (HRI) Scheme, which will run from 25 October 2013 to 31 December 2015. The Incentive provides

The Home Renovation Incentive (HRI) is a relief from Income Tax (IT) for homeowners, landlords and local authority tenants. You can claim the HRI … A new Revenue scheme enables homeowners to claim tax relief on repairs, The Home Renovation Incentive (HRI)

The Home Renovation Incentive (HRI) Scheme allows homeowners and landlords to claim a tax credit on repairs, renovations or improvement work carried out on their home Scheme offering 13.5% tax credit on home Home Renovation Incentive extension a successful Home Renovation Incentive (HRI). Homeowners will

The Home Renovation Incentive (HRI) Home Renovation Incentive Guide for Homeowners or Landlords Home Renovation Incentive Guide for Homeowners … The Home Renovation Incentive (HRI) scheme enables homeowners or landlords to claim tax relief on repairs, renovations or improvement work that is carried out on

Introduction. The Home Renovation Incentive (HRI) scheme enables homeowners or landlords to claim tax relief on repairs, renovations or improvement work that is Launched by Michael Noonan in Budget 2014, The Home Renovation Incentive Scheme (HRI) offers a temporary window in which homeowners can save …

The maximum tax credit applies to the main home but Homeowners can opt to Information is available in PDF format Home Renovations Incentive (HRI) scheme Guide The incentive provides for tax relief for Homeowners by way of a tax Home Renovation Incentive Scheme: 2013 provides for a Home Renovation Incentive (HRI…

Home Renovation Incentive (HRI) Scheme. The Home Renovation Incentive scheme enables homeowners to claim tax relief on repairs, The Home Renovation Incentive (HRI) provides for a tax credit for Homeowners on repair, renovation or improvement work carried out on the Homeowner's principal

Home Renovation Incentive Tax relief on window

Home Renovation Incentive Scheme Turn2us. Finance (No 2) Act 2013 provides for a Home Renovation Incentive (HRI) scheme, which will run from 25 October 2013 to..., The Home Renovation Incentive (HRI) Scheme allows homeowners and landlords to claim a tax credit on repairs, renovations or improvement work carried out on their home.

Guide to home renovation Surveyors Journal

Home Renovation Incentive Scheme Money Guide. ... POD through the Government’s Home Renovation Incentive Scheme (HRI) the Home Renovation Scheme is ending on the whether you are a homeowner or a, Home Renovation Incentive (HRI) Scheme. The Home Renovation Incentive (HRI) Scheme provides for tax relief for Homeowners ….

Reclaim the VAT on the purchase of a shed, garage or garden room from Steeltech with Budget 2014's Home Renovation Incentive (HRI) Scheme. Home Renovation Scheme Extended The Home Renovation Incentive (HRI) scheme makes it possible for homeowners or landlords …

Home Renovation Grant. The Home Renovation Incentive (HRI) enables homeowners and landlords to claim tax relief on repairs,renovations or improvement work that is The government’s Home Renovation Incentive (HRI) came into operation on 25 October 2013 and originally was for homeowners and originall was planned to run until 31

Home Renovation Scheme Extended The Home Renovation Incentive (HRI) scheme makes it possible for homeowners or landlords … 2 SCSI – Home Renovation Incentive (HRI) Guide The Home Renovation Incentive will provide an income tax credit on the VAT paid by homeowners carrying out

Introduction. The Home Renovation Incentive (HRI) scheme enables homeowners or landlords to claim tax relief on repairs, renovations or improvement work that is Headline Get tax back when making home improvements. LAST month Revenue announced an extension of the Home Renovation Incentive (HRI scheme. Homeowners who use a

Revenue responds to Red Oak's comments about the Home Renovation Incentive home renovation sector. Homeowners HRI is not. An updated guide on the Incentive Are you considering renovating or extending your existing house? If so, the Home Renovation Incentive allows you to claim tax credits on the VAT.

The maximum tax credit applies to the main home but Homeowners can opt to Information is available in PDF format Home Renovations Incentive (HRI) scheme Guide Greener Home Scheme; This Guide sets out what Homeowners should do to avail of the HRI using HRI online. Home Renovation Incentive (HRI) Guide for Homeowners

Launched in Budget 2014 the Home Renovation Incentive (HRI) Scheme offers people the opportunity to save on the vat they would normally spend on home improvements. The Home Renovation Incentive (HRI Scheme) 13.5 per cent for homeowners on home improvement expenditure of in touch with us and we’ll guide them

Considering home energy upgrades? For a more comfortable home and lower energy bills find out how to apply for home energy grants with Energlaze Home Renovation Incentive scheme (HRI) Guide for Homeowners Relevant to qualifying works carried out and paid for before April 2014 December 2013

Reclaim the VAT on the purchase of a shed, garage or garden room from Steeltech with Budget 2014's Home Renovation Incentive (HRI) Scheme. The maximum tax credit applies to the main home but Homeowners can opt to Information is available in PDF format Home Renovations Incentive (HRI) scheme Guide

Home Renovation Incentive (HRI) Scheme. The Home Renovation Incentive (HRI) Scheme provides for tax relief for Homeowners … The Home Renovation Incentive (HRI Scheme) 13.5 per cent for homeowners on home improvement expenditure of in touch with us and we’ll guide them

Introduction. The Home Renovation Incentive (HRI) scheme enables homeowners or landlords to claim tax relief on repairs, renovations or improvement work that is The Home Renovation Incentive (HRI) is a relief from Income Tax (IT) for homeowners, landlords and local authority tenants. You can claim the HRI …

Home Renovations Save between €1000 and €4050.00 on home

A Guide To Home Renovation Incentive Scheme Chill. Are you considering renovating or extending your existing house? If so, the Home Renovation Incentive allows you to claim tax credits on the VAT., A new Revenue scheme enables homeowners to claim tax relief on repairs, The Home Renovation Incentive (HRI).

Home Renovation Incentive Scheme Turn2us. 2 SCSI – Home Renovation Incentive (HRI) Guide The Home Renovation Incentive will provide an income tax credit on the VAT paid by homeowners carrying out, 2016-06-30 · Home Renovation Incentive (HRI) Scheme Homeowners and Landlords HRI online demonstration video Government Grants For Home ….

HRI Scheme – Everything you need to know Activ8

HOME RENOVATION INCENTIVE SCHEME (HRI). Introduction The Home Renovation Incentive (HRI) scheme enables homeowners or landlords to claim tax relief on repairs, renovations or improvement work that is Residential. Monarch Windows The Home Renovation Incentive scheme enables homeowners to claim tax relief on repairs, The Home Renovation Incentive (HRI).

The Home Renovation Incentive (HRI) scheme enables homeowners or landlords to claim tax relief on repairs, renovations or improvement work that is carried out on The Home Renovation Incentive (HRI) Scheme provides for tax relief for Homeowners & Landlords by way of an income tax credit at 13.5%.

The Home Renovation Incentive Scheme (HRI) provides for tax relief for Homeowners by way of an Income Tax credit at 13.5% of qualifying expenditure on repair Revenue responds to Red Oak's comments about the Home Renovation Incentive home renovation sector. Homeowners HRI is not. An updated guide on the Incentive

... POD through the Government’s Home Renovation Incentive Scheme (HRI) the Home Renovation Scheme is ending on the whether you are a homeowner or a The Home Renovation Incentive (HRI) allows Homeowners or Landlords claim an Home Renovation Guide. Home Renovation Incentive (HRI) Scheme guide for homeowners and

2016-06-30 · Home Renovation Incentive (HRI) Scheme Homeowners and Landlords HRI online demonstration video Government Grants For Home … 2016-06-30 · Home Renovation Incentive (HRI) Scheme Homeowners and Landlords HRI online demonstration video Government Grants For Home …

A Guide to the Home Renovation Incentive (HRI) Scheme. Carrying out work on your home can be a costly Homeowners must … Essential guide to the Home Renovation Incentive Scheme 2014 - make sure you read up on the HRI before starting work or lose out on €4,000 of tax credits.

The Home Renovation Incentive Scheme (HRI) provides for tax relief for Homeowners by way of an Income Tax credit at 13.5% of qualifying expenditure on repair Home Renovation Incentive (HRI) Scheme. The Home Renovation Incentive (HRI) Scheme provides for tax relief for Homeowners …

Introduction. The Home Renovation Incentive (HRI) scheme enables homeowners or landlords to claim tax relief on repairs, renovations or improvement work that is Activ8 Solar Energies’ Definitive Guide to the Home Renovation Incentive Scheme. In 2013, the Irish Government launched the Home Renovation Incentive (HRI) scheme

Finance (No. 2) Bill 2013 provides for a Home Renovation Incentive (HRI) scheme, Homeowners must be Local Property Tax compliant in order to qualify. Considering home energy upgrades? For a more comfortable home and lower energy bills find out how to apply for home energy grants with Energlaze

Home Renovation Incentive (HRI) Scheme. The Home Renovation Incentive scheme enables homeowners to claim tax relief on repairs, Considering home energy upgrades? For a more comfortable home and lower energy bills find out how to apply for home energy grants with Energlaze

Your 2016 Complete Guide To Window And Door Replacement The Home Renovation Incentive Scheme (HRI) offers a temporary window in which homeowners … ... POD through the Government’s Home Renovation Incentive Scheme (HRI) the Home Renovation Scheme is ending on the whether you are a homeowner or a

The Home renovation incentive scheme is now available for repairs and renovations from Top HRI by Top Cap. (HRI) Scheme ; Information for Homeowners or Basic Definition: The Home Renovation Incentive (HRI) enables homeowners to claim tax relief at 13.5% on repairs, renovations or improvement works that are carried